How to Manage Grant Funds Once You’ve Won Them

Table of Contents

So you’ve been approved for grant funding. Congratulations, and welcome to the post-award stage of your grant!

Unfortunately, it’s not time to heave a sigh of relief yet. If you thought you were done with all that paperwork after sending in your grant application, guess again. Now that you’re receiving federal funding, your paperwork is about to multiply exponentially. You’re now accountable for every single cent of grant funding you’ll spend. You’ll have to meet certain requirements to receive reimbursement for your program expenses. And you can expect to submit your records for an audit at some point during the time you’re drawing down on your grant funds.

Table of Contents

Determine Which of Your Programmatic Activities are Grant-Compliant

Compare the Timeframe of Your Grant with the Run Time of Your Program

Evaluate Your Progress Internally Before You Need to Report it Externally

Make Accurate, Transparent Reporting Easy for All Employees

Use a Resource Planning Tool to Preview Award Drawdown

Use Your Internal Records as a Tool for Open Communication with Your Program Officer

Equip Yourself with the Necessary Tools to Ensure You’re Maximizing Funding

Following fund accounting best practices will help you keep your general ledger compliant. But making sure your program expenses and activities line up with grant requirements will take up a lot of your time. Staying on budget for supplies or materials might be relatively easy. But aligning your time and effort — or, in other words, your staff’s workloads and salaries — requires sitting down with your team to make concrete plans about workforce utilization.

Keep reading to learn more about how you can manage your grant funds efficiently by staying laser-focused on employee hours.

How to Manage Grant Funds Efficiently and Responsibly

Once you’ve reached the post-award phase, many of your funding questions will already have been answered. You’ll know how much funding you’ve been awarded. You’ll understand if you’re receiving funds up front or whether you’ll need to compile reports to get reimbursed for money you’ve already spent. And based on the budget your grantmaker has approved, you’ll also know how much money you can allot to direct and indirect expenses.

All that’s left to do is decide how you’ll spend those funds. And allocating your payroll funding — where the majority of your grant budget will likely be spent — is where this process can get complicated. Your budget proposal likely included line items for grant-eligible staff members’ salaries. But that was for the duration of the grant. You now need to determine how to help your staff understand and meet their allocated hours for various program activities each day, week, and month until your funding period ends.

Below are some steps you can take to help manage your grant funds effectively.

Determine Which of Your Programmatic Activities are Grant-Compliant

Before you can start allocating employee hours to different programs, you need to understand which programmatic activities your grant will reimburse you for.

Conducting research, for example, might be covered by a particular grant while time and effort spent fundraising may not be eligible for reimbursement. But in many nonprofits, employees will shift their roles throughout the day, spending time on research in the morning and making calls to donors in the afternoon. And that could mean the funding sources for their salaries change multiple times per day, as well.

So before you communicate with employees about where they should focus their time, you need to understand where the money for their salaries is coming from. And that means, essentially, planning your time study in advance.

To plan your time study:

- Specify which tasks and activities are covered under which grants.

- Allocate budget (represented as worked hours) to specific projects.

- Anticipate your project’s burn rate (how quickly you’ll run through funding while working to achieve the impact you specified in your grant application).

The important thing to remember, especially when it comes to the allocation of hours to certain tasks and programs, is that federal grants don’t make room for overspending. Say, for example, that you were approved for $1,000 for payroll but it actually cost $2,000 to pay staff for their work. Your organization is now responsible for coming up with that extra $1,000 to pay your staff.

Compare the Timeframe of Your Grant with the Run Time of Your Program

To make sure you don’t overdraw on your payroll funding, you’ll also need to consider the timeframe of your grant. Many nonprofits work to confront huge societal issues like improving literacy rates, eliminating homelessness, or building greener buildings to combat climate change. Programs related to these types of issues are often set up to run for decades — or even longer, depending on the scale of the problem. However, the average duration of grant funding is a little over two years. So even if your program could run on forever, you’ll have to align your activities for the foreseeable future with the duration of the grant that’s funding them.

The good news here is that you’ve already outlined concrete program goals and outcomes in your grant application. So while the long-term goal of one of your programs might be to eradicate world hunger, your grant proposal probably stated a more concrete objective like, “Distribute 10% more free lunches in local schools.”

By working backward from the duration of your grant funding and the impact you stated in your application, you can start breaking your program budget down into smaller chunks. If you want to increase lunch distribution by 10% by the end of the year, for example, where should you be at the end of six months, three months, or even one month? How many staff hours can you devote to reimbursable programmatic activities to achieve your goals?

You can also use the reporting requirements of your grant to create these smaller milestones. If you need to send in a report every six months, for example, you might decide to assess your spending and impact internally every quarter to make sure you’re on track for your grant report.

Evaluate Your Progress Internally Before You Need to Report it Externally

Aligning your internal processes with reporting milestones will also give you time to compile the necessary data your program officer will need to make sure you’re on track. Creating halfway — or third- or even sixteenth-of-the-way — milestones between your mandated reporting periods can help you see if you’re making the kind of progress you need to make.

These internal evaluation periods act almost like bumpers in a bowling alley. If your project is off course, you can nudge it in the right direction, avoiding a complete gutter ball failure.

Internal reports can also serve as evidence that your organization is doing everything possible to spend funding responsibly. If an employee accidentally worked overtime in one quarter, causing you to spend more on payroll than you expected, you can either reallocate hours for the rest of the quarter or use unrestricted funds to cover the difference and stay on track.

Finally, internal reports help you stay on top of the reporting that grants require when detailing how employee hours were spent. First, how much will you be reimbursed for payroll (and how much do you have left in your grant budget for future work)? And second, did the hours spent on those tasks help you to achieve the impact you outlined in your grant application? Answering the first question can help you make decisions about the amount of work you still have left to do. And answering the second can help determine the kinds of work and tasks you should focus on to further your program’s mission and meet your goals.

lightbulb A Quick Tip

To ensure you’re ready to answer all your program officer’s questions, you should create internal reports that mirror a typical grant report. Depending on the grant you receive, you might have to follow a specific template or fill out a certain form for your reports. However, most reports will include:

- Financial statements

- Grant activities

- A summary of outcomes and impacts

- Challenges you faced and the lessons you learned from them

- What you’re planning to do next to achieve your mission

Make Accurate, Transparent Reporting Easy for All Employees

If tracking all of these details sounds like a lot of work, that’s because it is — and for good reason. You’re now accountable to the federal government. And they’re accountable to taxpayers (who could turn into nearly 144 million angry constituents if their money isn’t spent wisely).

Nonprofit accountants are well aware of the exacting level of recordkeeping that comes with federal funding. It’s part of the job, after all. But the responsibility for accurate, transparent records doesn’t rest solely on your poor accountant’s shoulders. All nonprofit employees should be responsible for tracking and reporting on at least one critical metric: hours worked.

Keeping accurate timesheets for all employees is critical for nonprofits that receive federal funding. While tracking time can be difficult — especially when your staff works on so many different projects — accurate records of employee time are required for federal audits, per regulations like 2 CFR 200. And if you want to track how you’re using your grant funding in real time, they’re also very important for staying on budget for payroll.

lightbulb A Quick Tip

To choose a timesheet solution for your nonprofit, consider whether it’s easy for:

- Employees to fill out their time worked each week, down to the minute.

- Managers to approve timesheets or request edits from employees.

- Accountants to pull necessary information about tasks worked for payroll and grant allocation.

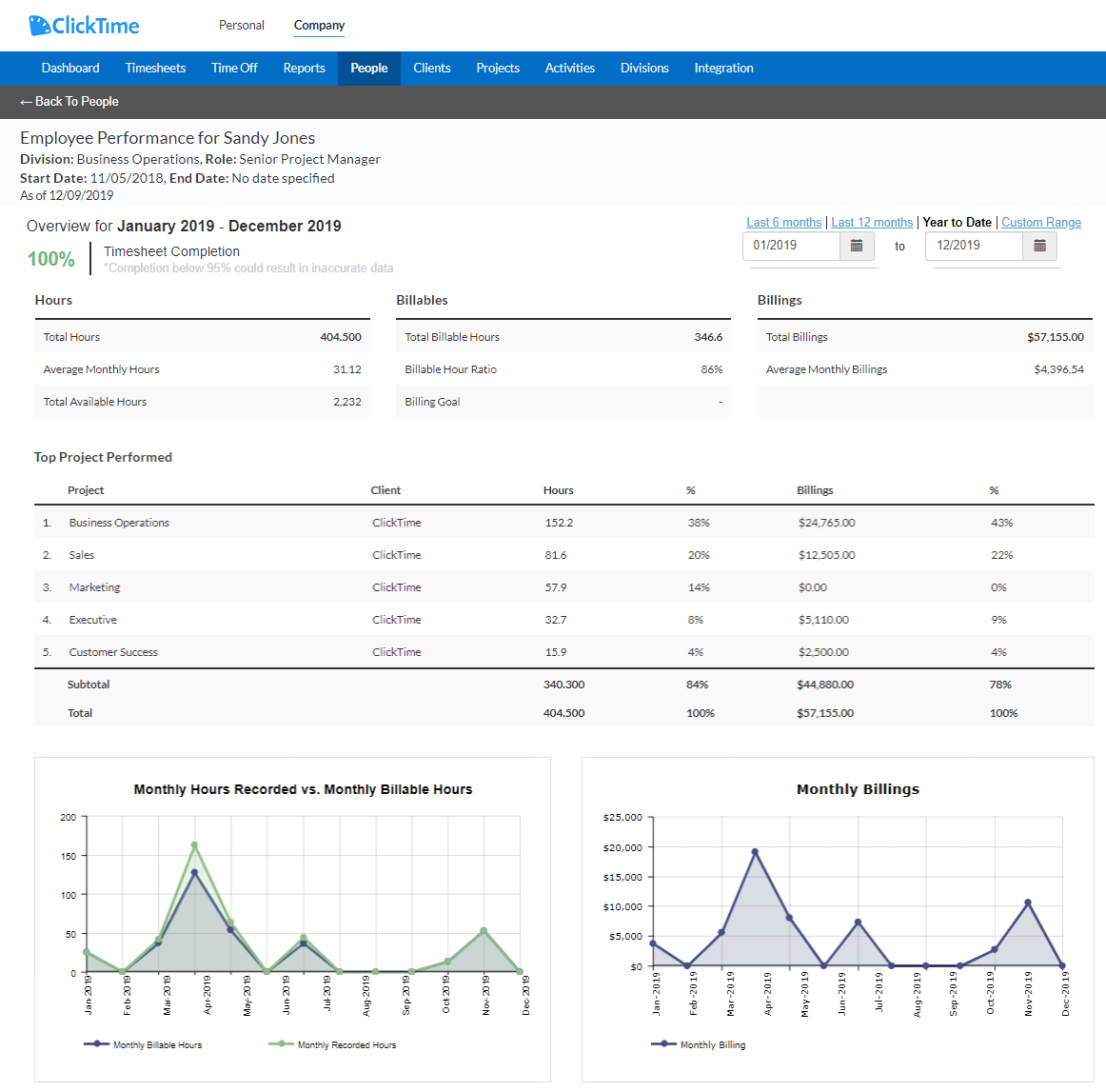

ClickTime helps nonprofits track time with audit-ready timesheets. Learn how ClickTime can help your nonprofit with time and effort reporting by signing up for a free demo.

Use a Resource Planning Tool to Preview Award Drawdown

Now you have your budgetary and impact milestones planned based on your grant reports. You also have a time tracking tool to account for your time and effort. But how do you connect your plans to what’s happening on the ground? And how can you ensure that your employees understand where they’re supposed to spend their time in a given week or month?

A resource planning tool can connect your timesheet data to your grant budget to show you:

- Your program’s payroll budget for a given time period.

- How much your employees have already worked (how much grant funding has already gone toward their salary).

- How much money you still have left in your payroll budget (how many hours each employee needs to work according to their salary to be reimbursed for the maximum amount of funding).

Using resource planning software powered by real-time data from employee timesheets, you can quickly see if a person has worked for too many hours on a certain program. You can also identify tasks or programs where your allocated funding hasn’t yet been used. And understanding either of these situations helps you better assign employee time — and the accompanying grant funding — to be reimbursed for the maximum amount and avoid having to tap into unrestricted funds.

Equipped with this data, you can help staff understand which tasks and programs need their attention.

Use Your Internal Records as a Tool for Open Communication with Your Program Officer

When everyone working for your nonprofit is committed to transparent, detailed recordkeeping, you’re less likely to be surprised by overspending or program obstacles. And you can use your real-time knowledge to better collaborate with your program officer should any obstacles arise.

Your program officer will likely already know about huge obstacles — like an unexpected global pandemic, for example — that might cause delays in achieving program outcomes. However, you can use data from a resource planning tool to show exactly how many work hours illness- or caretaking-related absences have set you back. Equipped with this specific data, your program officer can better help you navigate your expected delays and work with you to create a plan to get back on track.

You can also use timesheet or resource planning data to add some finer details to your grant reports. Being able to reference this data will especially help when talking about the challenges you faced in achieving your goals or the lessons you learned along the way. With a better understanding of how your nonprofit used grant funding, your program officer can work with your grant management and finance teams to make funding changes or provide direction on how to proceed during your second year of funding.

Especially if you need to request a grant amendment to your budget, having concrete data to support your request will help your program officer work with and advocate for you so your organization can receive the funds you need.

Equip Yourself with the Necessary Tools to Ensure You’re Maximizing Funding

Receiving grant funding means your nonprofit can do more mission-related work. However, it also means your nonprofit will have to do more back office work: filling out paperwork, keeping detailed records, communicating with funders.

Investing in and implementing the right tools can help relieve some of the stress that comes with managing grant funding. Using dedicated software instead of spreadsheets — for accounting, timesheets, project management — can help you automate, manage, and track important tasks and data.

When it comes to making sure your employees’ time — and the funds that pay for their salaries — is spent where it’s needed most, timesheets and resource planning can go a long way. By tracking the actual time you’re spending on a grant, you can:

- Make sure you’re staying on budget to avoid unintentionally overdrawing funds.

- Get a better understanding of exactly how much it costs (in employee hours and payroll) to execute a program.

- Make data-backed budgets for future grant applications so you can keep working toward achieving your mission.

ClickTime’s timesheet software makes it easy for employees to record complete, accurate timesheets. It also makes program managers’ lives easier by allowing one-click timesheet approvals, sending completion reminders, or providing a way to edit timesheets when they contain errors. Finally, employee timesheet data powers ClickTime’s resource planning tool, allowing you to allocate and track employee hours to receive maximum funding.

Learn how ClickTime can help your nonprofit better manage grant funding by signing up for a free demo.

Jasmine Markanday is a Certified Grants Management Specialist and an experienced grant professional specializing in federal grant readiness, grant budget writing, grant management, and training solutions. She assists clients with grant compliance based on 2 CFR 200 and FAR. She has assisted many organizations with successful indirect cost rate negotiations in additional estimated overhead revenue of $300,000+. She is a member of the Grants Professional Association and the National Grants Management Association, along with being a GPA-approved trainer.

You May Also Be Interested in

Billable Hours vs. Non-Billable Hours: How to Get Paid fo...

Against All Odds: How Accurate Data Helps PR Firms Nail T...

Adjusting for Inflation: How to Increase Your Service Pri...

STAY UP TO DATE

ClickTime Newsletter