Nonprofit Finance: The Fastest, Most Accurate Way to Invoice Your Funders

Table of Contents

If your nonprofit regularly wins grants, congratulations! That’s the key to unlocking a great number of funding opportunities for your organization. However, nonprofits often leave funds on the table because they don’t invoice their funders for applicable payroll expenses.

When you apply for a grant, it will likely have regulations and guidelines for how the money can be used. Not only does this require you to keep track of the regulations for each grant, but you’ll also need to keep track of every dollar spent that falls within these guidelines to invoice the funder down the line.

This is often easier said than done. It tends to be simple to allocate many direct expenses to specific projects and funds, but when it comes to expenses such as payroll — which could be either a direct or indirect expense based on the task performed or the person performing it — funds can be much more challenging to allocate.

Before allocating these funds and invoicing grantors, nonprofits must track the amount of time and energy spent on specific projects and tasks, then assign them a monetary value.

3 Tips for Organizing Your Funder Invoicing Process

The allocation process can be complicated and take up a lot of time. So how can you be sure to invoice your funders correctly, efficiently, and quickly? It all starts with an effective method of organization at your nonprofit.

1

Set up an Organized Finance System

As we mentioned, one challenge of allocating expenses such as payroll is having to measure multiple metrics beyond just finances.

If you purchase a piece of technology or tool for one of your projects, it’s easy to assign a specific monetary value to that tool— it’s worth the amount of money that you spent on it. But how can you attach a monetary value to a person’s time? Generally, we do so by dedicating a salary or hourly wage in exchange for the team member’s time. Therefore, your management needs to identify the amount of time and monetary value of that time spent on each grant-related activity.

As you can tell, this process requires your nonprofit to be immensely organized with your time and financial resources. The first step to achieving this level of organization is investing in the best software.

Invest in the best software.

There are likely several software solutions your nonprofit uses to keep your data in check. From your CRM to your fundraising and marketing solutions, you have many tools you leverage to ensure various processes work seamlessly. Finances are no different. To start, you’ll need to invest in accounting, grant management, and time tracking software.

Nonprofit Accounting Software

If you’re trying to pigeonhole your current financial data into a standard accounting solution, you’re probably going to struggle to allocate funds appropriately because for-profit organizations that use this software do not operate with fund accounting.

Allocating funds to restricted, temporarily restricted, and unrestricted classifications is the backbone of the nonprofit accounting system. Jitasa’s nonprofit accounting guide explains that this system allows nonprofit benefactors (like your grant funders) the ability to “make sure their funds are spent on the agreed-upon programs.”

Of course, you’re likely aware of the importance of staying compliant with your funders. But if you don’t have access to a fund accounting solution, you run the risk of double counting expenses to multiple grants, which often causes grantors to refuse to reimburse your nonprofit. Or, you might miss an expense that could be reimbursed on your invoice, meaning you end up paying for the expense yourself out of your unrestricted funds.

The moral of the story? Invest in accounting software specifically designed for nonprofits or that can be configured to meet your fund accounting needs.

Grant Management Software

Nonprofit CRM software often offers a feature that will help you track the progress of grant writing, winning grants, and identifying the guidelines associated with each one. If you don’t have access to this important feature, you might consider investing in grant-specific software to make sure you can keep track of these important steps.

Not only will grant management software help you keep track of the application process, but it will also help you understand the agreed-upon terms that the funder requires of your organization to receive those funds. It will help you keep track of the approved program expenses for reimbursement, the timeline for invoicing, and more.

Time Tracking Software

As we mentioned, one of the most challenging aspects of invoicing is tracking payroll. To accurately track the time spent on specific projects and activities, you’ll need access to time tracking software.

Your employees’ timesheet data needs to be accurate and complete in order to correctly match it to the right projects and to calculate the amount of payroll that can be covered by grants.

It’s helpful to choose a time tracking solution that offers timesheet reminders, completion dashboards, approval workflows, and manager override capabilities to hold everyone accountable and ensure everything is done correctly.

lightbulb A Quick Tip

When time tracking software integrates with your accounting system, you can automatically calculate the payroll funds that can be allocated to specific projects based on accurate timesheets, speeding up the process.

Create team-wide finance processes.

Software is only helpful and handy for organizations that understand how to use it well. That’s why, in addition to having the right software on hand, you’ll need to make sure your team is trained to use it and has well-designed processes to check on metrics and ensure accuracy.

Set expectations with the team members who will need to track their time to make sure they’re logging hours under the correct projects. Then, work with management to devise oversight processes to ensure timesheets are correct and accurate. Managers should check these regularly to reduce the probability of a complete overhaul of timesheet data and information at the last minute.

Be sure to assign specific roles so everyone knows whose job it is to:

- Track time.

- Oversee timesheets.

- Sync data with finance software.

- Calculate the allocation of payroll funds for specific functional expense allocations.

- Send the invoice to funders on time.

When inaccurate timesheet data is sent to accounting, your finance team will need to scramble to fix the information before it impacts other processes down the line, like payroll and invoicing. It’s much better to develop team-wide processes upfront to ensure everything is completed accurately on the first attempt.

When everyone is on the same page regarding the process, you’ll be more likely to maintain accurate information, making it easier to quickly send invoices on time.

2

Determine the Invoicing Timeline

Once you have your internal team processes in place and are certain your information will be up-to-date at any point, you should create a timeline for the invoicing process. Different grantors will have individual guidelines you must adhere to, including specific deadlines. The last thing you want is to accidentally miss a deadline.

Plus, the timeline between payroll and invoicing grantors can be short. Everything you can do to make the invoicing process easier, more precise, and timely will help establish a relationship of trust with your grantor.

Therefore, create a timeline with all deadlines for upcoming invoices. Be sure this timeline is shared across your team so everyone knows when their information will be due. Set up reminders to give yourself and your finance team plenty of time to review the invoicing information before it’s sent off.

For example, you might create a plan for a week in advance for each management team member that allows everyone to double-check the data for every invoice. This might look something like this:

-

Weekly Plan

- todayMonday: Manager double checks all invoices and conducts overrides if necessary for team member timesheets.

- todayTuesday: Timesheets are sent to the accounting department to be checked again and (re)allocated to the appropriate projects.

- todayWednesday: Funds are calculated according to the timesheet data and allocated to the right funding source.

- todayThursday: This financial information is verified and compiled into the upcoming invoice document.

- todayFriday: The invoice is finalized, reviewed by managers, and sent off to the grantor.

In this case, the grantor invoice is due on Friday, so you should plan out the other activities leading up to that date with enough elbow room to get everything done. Be sure to do this for each grant invoice you must send, always accounting for the already-reimbursed expenses.

3

Create a Template for Invoices

Most invoices require the same type of information. By including detailed information in your invoices, you can fulfill grantor requirements while also creating an audit trail.

According to this guide, if your organization receives more than $750,000 in federal funding, you’ll need to conduct a financial audit. Some states also require an audit if you meet specific requirements (usually if you spend or earn more than a certain amount — generally around $500,000). Additionally, there are plenty of other one-off reasons why you might conduct an audit.

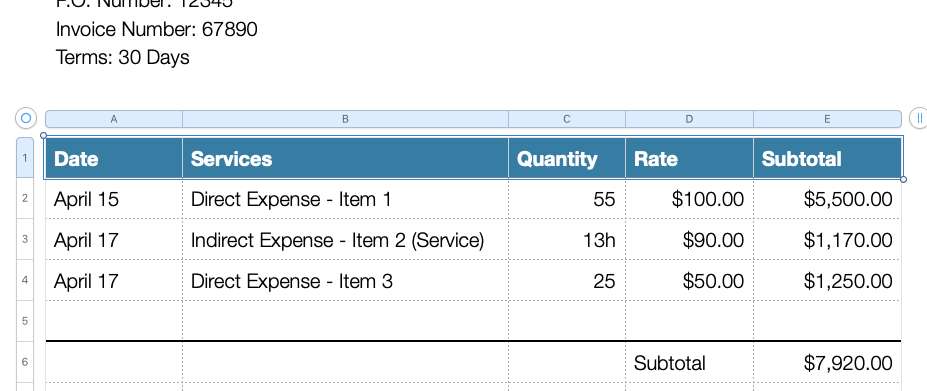

Therefore, you should always make sure your invoices include enough information to create a detailed trail for potential audits. Generally, your invoices will include a professional header, contact information, and an invoice number or date. Then, for the meat of the content, you’ll itemize the services you’re requesting reimbursement for.

The itemized breakdown of services is usually separated into multiple columns. These columns include:

- Services — A description of the program or service you’ve funded with the grant monies.

- Date — The date on which you spent the funds for which you’re requesting reimbursement.

- Quantity — For direct expenses, this is the number of items that were purchased with the monies. For the payroll expenses, it refers to the number of hours worked on the project or service.

- Rate — The amount paid for each good or service.

- Subtotal — The total reimbursement amount you’re requesting from the grantor.

When you send your invoices, don’t forget that they’re professional documents that should reflect your nonprofit’s brand. Be sure to include your logo and brand colors to reflect the professionalism of your nonprofit.

By creating a template that includes all of your brand elements and dedicated spots for each of the itemized services, you’ll be sure not to miss any information. Plus, you’ll be able to simply plug in the right information based on your financial reports and send off the invoice. You won’t have to start from scratch each time, saving time and energy for you and your staff members.

Be sure to make two copies of each invoice — one to send to your grantor and the other to keep in a secure and organized location at your organization. Again, this helps create an audit trail and allows you to keep track of your organization’s financial data.

Don’t Wait Until an Audit to Get Organized

The deadline of grantor invoices can sneak up on you. Stay ahead of this process with accurate financial and timesheet records. Also, create thorough data hygiene processes, finalize timelines between departments, and ensure you include all necessary information on your invoice to create a concrete audit trail.

Ensuring accuracy while invoicing in a timely manner is challenging. But the right technology, processes, and templates can help eliminate some of the obstacles associated with this necessary process.

ClickTime is time tracking software that can help you organize your employees’ timesheet records. With easy time entries, approval workflows, and federally-compliant timestamps, it’s a tool employees, managers, and auditors will love. Learn how ClickTime can help your nonprofit get organized by requesting your free demo today.

Jon Osterburg has spent the last ten years helping more than 200 nonprofits around the world with their finances as a leader at Jitasa, an accounting firm that offers bookkeeping and accounting services to nonprofit organizations.

You May Also Be Interested in

Billable Hours vs. Non-Billable Hours: How to Get Paid fo...

Against All Odds: How Accurate Data Helps PR Firms Nail T...

Adjusting for Inflation: How to Increase Your Service Pri...

STAY UP TO DATE

ClickTime Newsletter